Menu

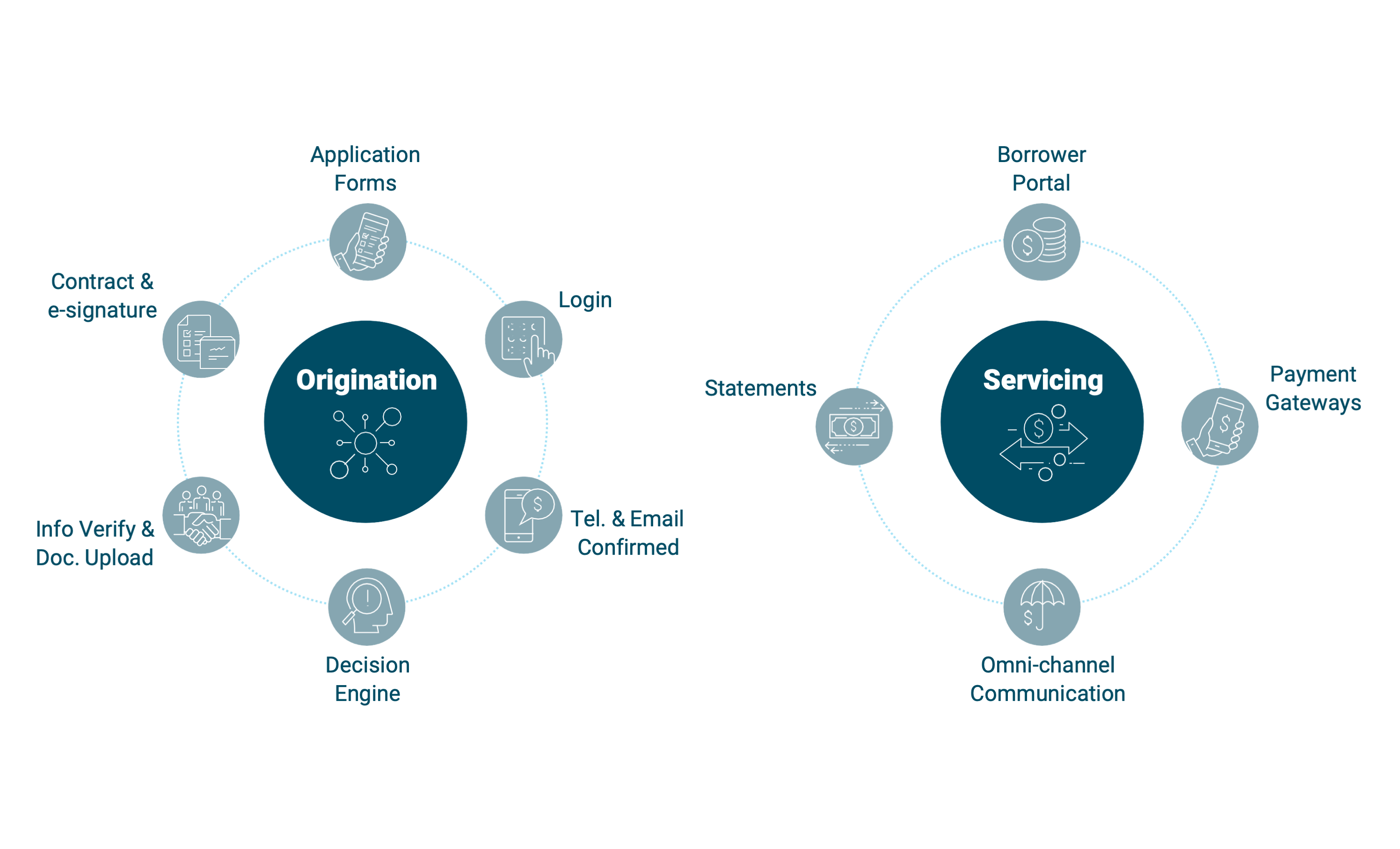

Quotanda provides a complete solution for Income Share Agreements (ISAs) so schools can offer financing programs based on future income, expanding access to education and aligning interests

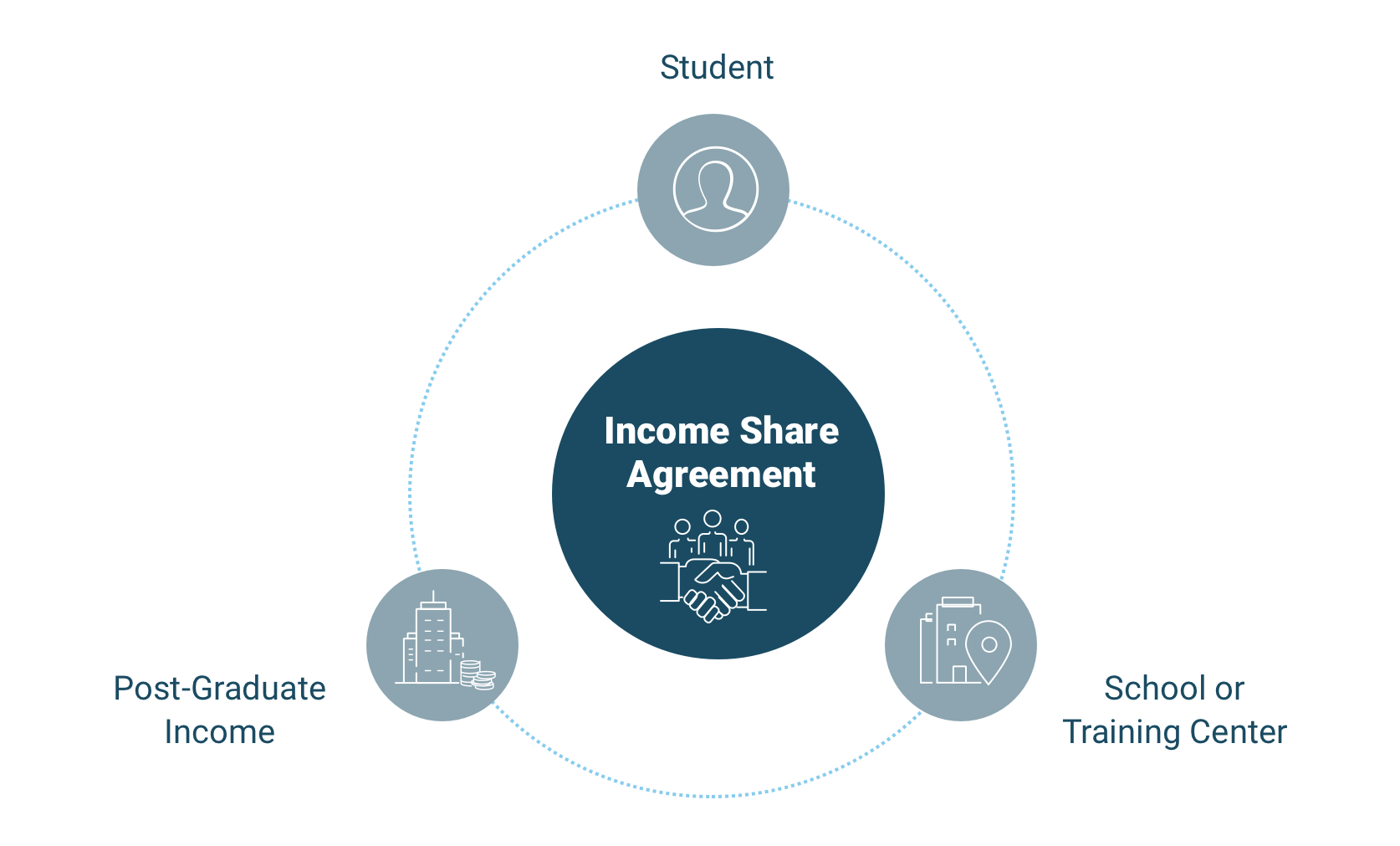

An Income Share Agreement is a contract between the student and the school. The student receives funds for tuition in exchange of sharing a fixed percentage of future income for a defined period of time. Because the amount paid by the student is based on income, payments should always be affordable. These contracts help reduce financial barriers to education, align incentives between schools and students and improve the image of the university, school or bootcamp.

An innovative payment solution that help schools to atract the best talent.

80% of our students wouldn't be able to pay their tuition without finance.

A tailored payment model, aligned with employment results and based on student success.

Pedro is keen to become a full-stack developer at a code bootcamp. Unfortunately, he can’t pay for the cost of tuition up-front. He goes looking for financing options.

One school captures Pedro’s attention. They have a flexible financing option that allows students to study in exchange for paying a percentage of their future income. He won’t pay anything until he starts working but he’ll probably pay more than the original tuition amount.

After graduating, it takes Pedro five months to land a job. During those five months, he didn’t have to make monthly payments. This flexibility allowed him to find a job he loves and to comfortably repay his Income Share Agreement.

Loan platform as a service or LaaS (for its acronym in English Lending as a Service) that provides a range of different borrower loans.

© 2024 Quotanda